1099-g Alaska

Alaska does not have state filing requirements for 1099Misc 1099-NEC 1099-K and W-2 at this time. Form 1099-G also reports any amount of federal Box 4 and state Box 11 income tax withheld.

1099 R News For Retirees Alaska Division Of Retirement And Benefits

JUNEAU Alaska Alaska Department of Labor and Workforce Development issues Form 1099-G to individuals who file for unemployment insurance benefits.

1099-g alaska. It is likely that it is still on the way. Permanent Fund Dividend Division. 1099-Gs are only issued to the individual to whom benefits were paid.

Department issues Form 1099-G for those who file for unemployment insurance benefits added by Alaska Department of Labor and Workforce Development on Feb 2 2021. If the 1099-G is to report unemployment compensation you should contact your local unemployment office. The state does not collect income tax.

All Form 1099-G Revisions. If you have the total of amount received you can calculate similar to the method the original poster described from the prior tax year. These are the states that will automatically mail your Form 1099-G.

State or local income tax refunds credits or offsets. Reemployment trade adjustment assistance payments. 1-888-209-8124 This is an.

Your state unemployment office will usually mail you this form by January 31 of each year if you received unemployment compensation the prior year. 2021 1099-G Certain Government Payments Federal Copy A laser cut sheet. Publication 1220 Specifications for Electronic Filing of Forms 1097 1098 1099 3921 3922 5498 and W-2G PDF.

However they do not have to be sent to you until January 31. Alaska Tax Service specializes in personal small business partnership and corporate as well as works closely with Bush communities and. Alaska law imposes severe penalties for attempting to collect benefits to which you are not entitled.

Vides utility payment assis-3. Online Ordering for Information Returns and Employer Returns. Except as explained below this is your taxable amount.

All fraud cases are subject to criminal prosecution fines. 85 x 11 Printed in Red drop out ink and Black ink 1. Sometimes the court will send you a 1099-G or 1099-MISC form with your jury duty payment other times you wont receive a 1099.

If you are married filing jointly each spouse must figure his or her taxable amount separately. You should be receiving a 1099-G from the government entity that paid you the benefit. 1099 State Reporting Requirements 2021.

If you expect to. They can get you one that you should be able to pick up If the 1009-G was state tax refund then you need to contact your states department of revenue or taxation office and request they send you another copy. Combine the box 1 amounts from all Forms 1099-G and report the total as income on the unemployment compensation line of your tax return.

How do I get Form 1099-G. By January 31 2021 the Division will send the 1099-G for Calendar Year 2020. You dont need to attach Form 1099-G to your Form 1040 or Form 1040-SR.

Form 1099-G or record of unemployment received and any federal tax withheld from unemployment. Alaska state filing agency. Even though the State of Alaska does not require 1099 Form the IRS still requires you to file Form 1099 to report payments and the taxes withheld for each of your recipients for the year.

To access this form please follow these instructions. While jury duty pay in Alaska wont add up to much the IRS considers it to be taxable income. 1099-Gs are not available until mid-January 2021.

In Box 4 you will see the amount of federal income tax that was withheld. Thousands of Alaskans were impacted by the COVID-19 pandemic in 2020 and correctly received. How to Get Your 1099-G online.

File Form 1099 Now with TaxBandits an IRS-Authorized e-file. How to get a copy online of my 1099G for UI state of AK. Mileage reimbursements and jury duty pay.

If taxes were withheld from your or your childs PFD report the withheld amount on IRS form 1040 on the line for Federal Tax Withheld If a refund is due after you report the dividend and. In Box 1 you will see the total amount of unemployment benefits you received. Additional information or documents you will need.

If you are married filing jointly each spouse must figure his or her taxable amount separately. All income information such as Forms W-2 1099-Misc 1099-INT 1099-DIV SSA-1099 or RRB-1099 and 1099R. Combine the box 1 amounts from all Forms 1099-G and report the total as income on the unemployment compensation line of your tax return.

All income information such as Forms W-2 1099-Misc 1099-INT 1099-DIV SSA-1099 or RRB-1099 and 1099R. Social Security cards or current record of SSNs for you spouse and all dependents. If you expect to.

By January 31 2021 the Division will deliver the 1099-G for Calendar Year 2020. If you do not have an online account with NYSDOL you may call. The 1099-G form for calendar year 2020 will be available in your online account at labornygovsignin to download and print by the end of January 2021.

Alaska Department of Revenue httpdoralaskagov. Find out how you can obtain your 1099-G. This 1099-G form is used for federal state or local governments if they made payments of unemployment compensation.

Under federal law unemployment insurance benefits are taxable income and must be reported to the IRS. Except as explained below this is your taxable amount. Alaska Tax Service is looking for a Tax Professional to join our team.

In Box 11 you will see the amount of state income tax that was withheld. Anchorage AK 99501 Please bring the following items with you. These are the states that will automatically mail your Form 1099-G.

The state of Alaska does not require you to file Form 1099 as there is no state. Fraud is knowingly making a false statement misrepresenting a material fact or withholding information to obtain benefits.

Alaska Department Of Revenue Tax Division

Fillable Online Juneau Salestax Non Profit Exemption Certificat Application Sales Tax Alaska Juneau Fax Email Print Pdffiller

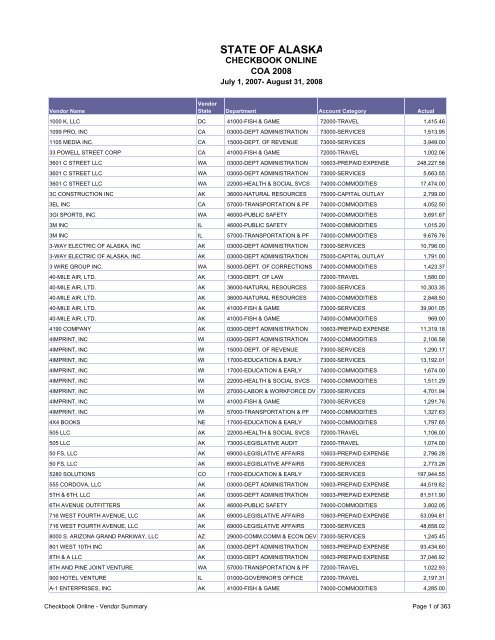

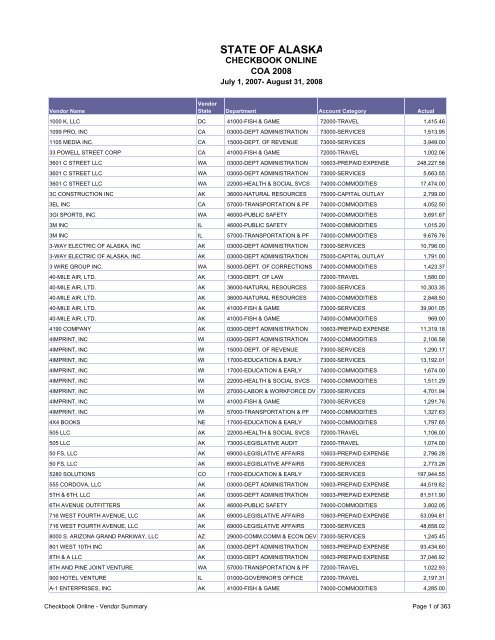

Pdf Administration State Of Alaska

1099g Alaska Fill Online Printable Fillable Blank Pdffiller

Alaska Department Of Revenue Tax Division

1099 G Alaska Fill Online Printable Fillable Blank Pdffiller

1099g Alaska Fill Online Printable Fillable Blank Pdffiller

1099 G Alaska Fill Online Printable Fillable Blank Pdffiller

Alaska Department Of Revenue Tax Division

2015 2021 Form Ak Dr 100 Fill Online Printable Fillable Blank Pdffiller

Alaska Unemployment Benefits Eligibility Claims

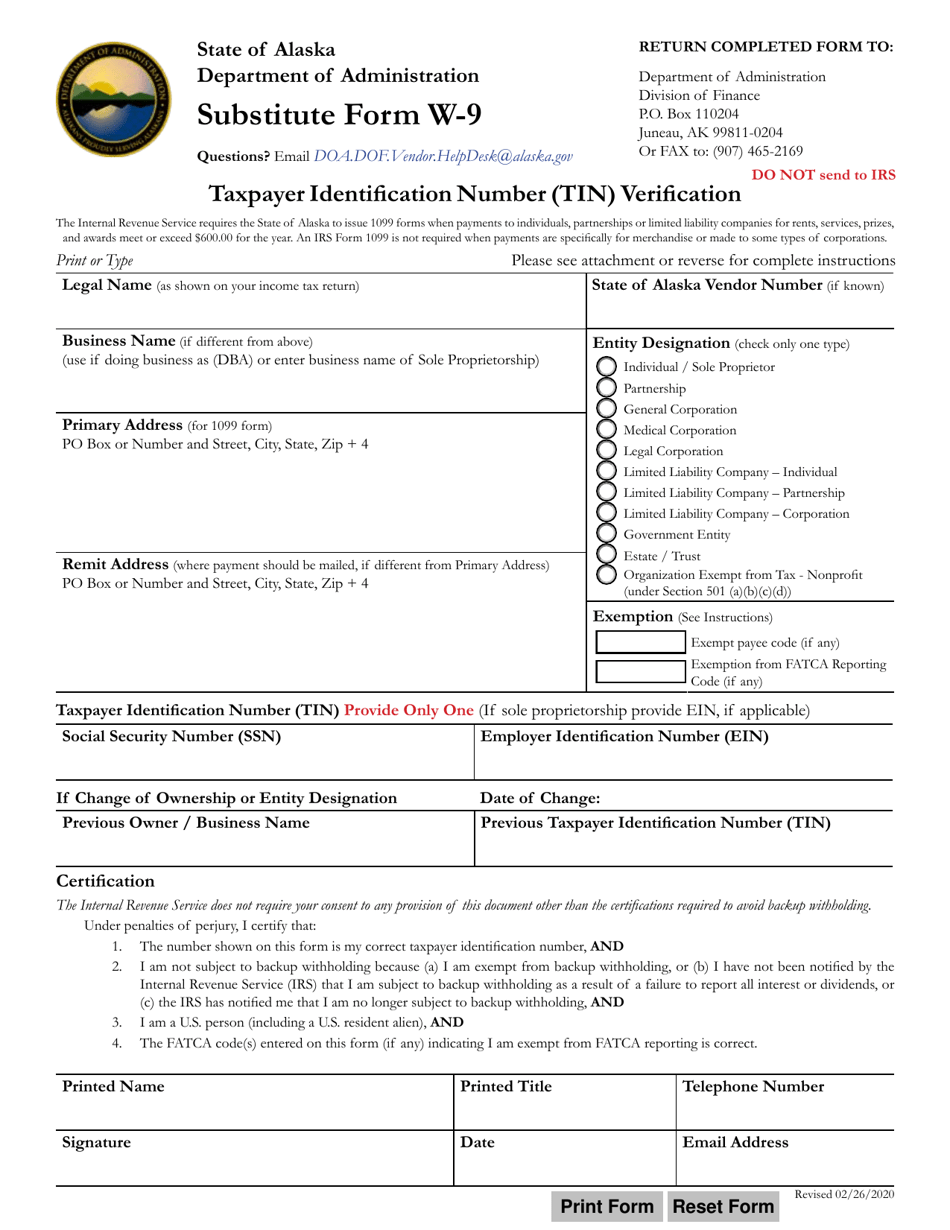

Form W 9 Download Fillable Pdf Or Fill Online Taxpayer Identification Number Tin Verification Alaska Templateroller

Posting Komentar untuk "1099-g Alaska"